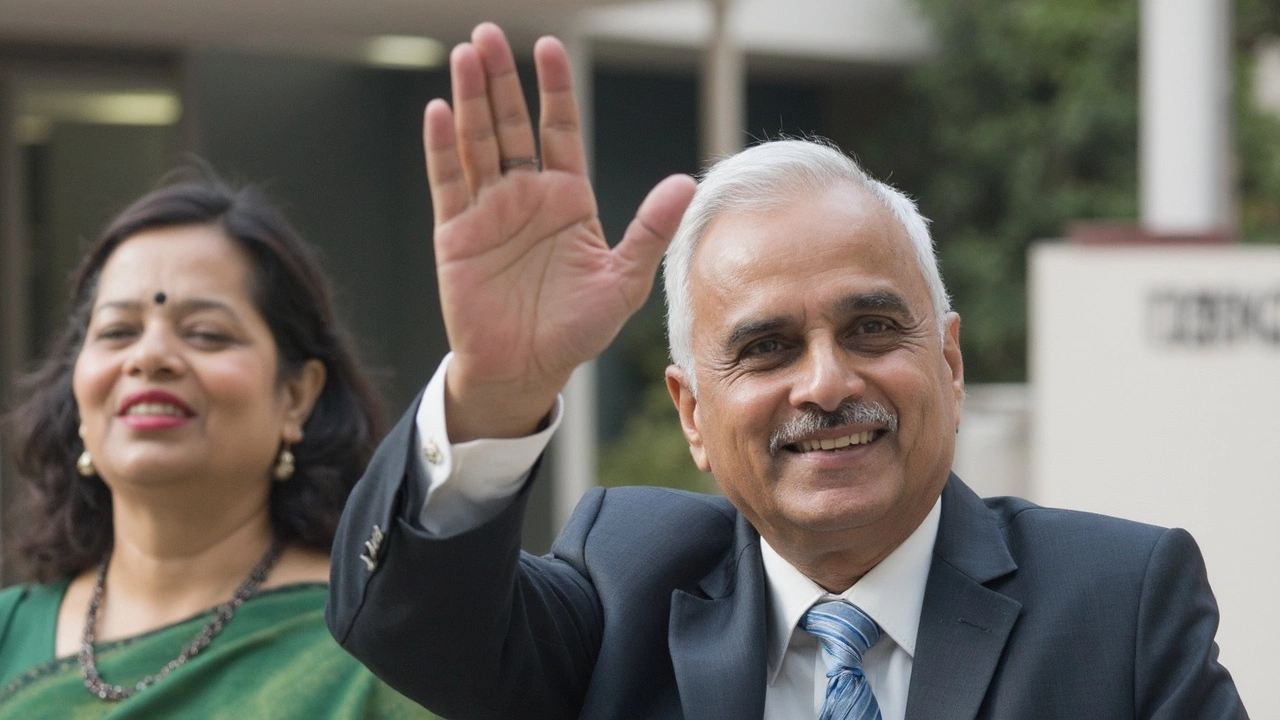

Shaktikanta Das – What You Need to Know About India's RBI Governor

If you follow Indian finance, you’ve probably heard the name Shaktikanta Das a lot. He’s the man behind the Reserve Bank of India’s (RBI) everyday moves, from interest rates to digital payment rules. In this page we break down who he is, why his calls matter, and the biggest headlines you shouldn’t miss.

Why Shaktikanta Das Matters

Shaktikanta Das became RBI Governor in December 2018. Since then, his job has been to keep the economy stable, control inflation, and push financial inclusion. When he tweaks the repo rate, banks change loan costs, which directly hits your mortgage or car loan. His push for digital wallets and UPI has turned phone payments into a norm for millions of Indians.

One of his most talked‑about moves was the February 2023 rate hike aimed at taming rising food prices. The decision sparked debate, but it showed his willingness to act when inflation spikes. He also championed the “RBI Vision 2025,” a plan that focuses on clean money, better credit flow, and tighter supervision of non‑bank lenders.

Recent Highlights and What’s Coming Next

In the past six months, Das has focused on three key areas: curbing inflation, improving banking health, and expanding digital finance. The latest Monetary Policy Committee (MPC) meeting kept the repo rate steady at 6.5%, signaling confidence that inflation is edging down. At the same time, the RBI released new guidelines for fintech firms, giving them a clearer regulatory path while protecting consumers.

Another headline was the RBI’s push for “green finance.” Das announced a pilot scheme for green bonds, encouraging banks to lend to eco‑friendly projects. This move ties India’s financial system to its climate goals, showing that the governor is looking beyond short‑term numbers.

What should you watch for? Keep an eye on the next MPC meeting (usually every two months). Any change in the repo rate or the cash reserve ratio will affect savings interest, loan costs, and even the rupee’s strength. Also, watch for updates on the new digital identity rule, which could streamline KYC for bank accounts and speed up credit approvals.For everyday folks, the most practical tip is to stay updated on RBI announcements via trusted news sources or the RBI’s own website. A small shift in policy can mean lower EMIs or higher returns on fixed deposits, so knowing what’s coming helps you plan better.

In short, Shaktikanta Das is more than a name on a press release – his decisions ripple through your wallet, your business, and the broader economy. By following his policy moves, you get a clearer picture of where Indian finance is headed and can make smarter money choices.

- Mar, 1 2025

- Comments 0

Former RBI Governor Shaktikanta Das Takes on New Role as Second Principal Secretary to PM Modi

- Feb, 28 2025

- Comments 0